The Cardinal System

The Cardinal System is a fully quantitative strategy specializing in the global currency markets, powered by non-correlated proprietary algorithms and advanced statistical models.

Built on over 20 years of market data analysis, the system is designed to deliver consistent, risk-adjusted returns across varying market conditions.

The strategy targets approximately 15-20% compound annualized growth (CAGR) with an emphasis on disciplined risk management, historically limiting drawdowns to around 10% annually in testing and live execution.

Cardinal Fact Sheet as of November 2025

Capital Series Structure

Series 1 - Principal Class

Series 2 - Founders Class

Series 3 - Investor Series A

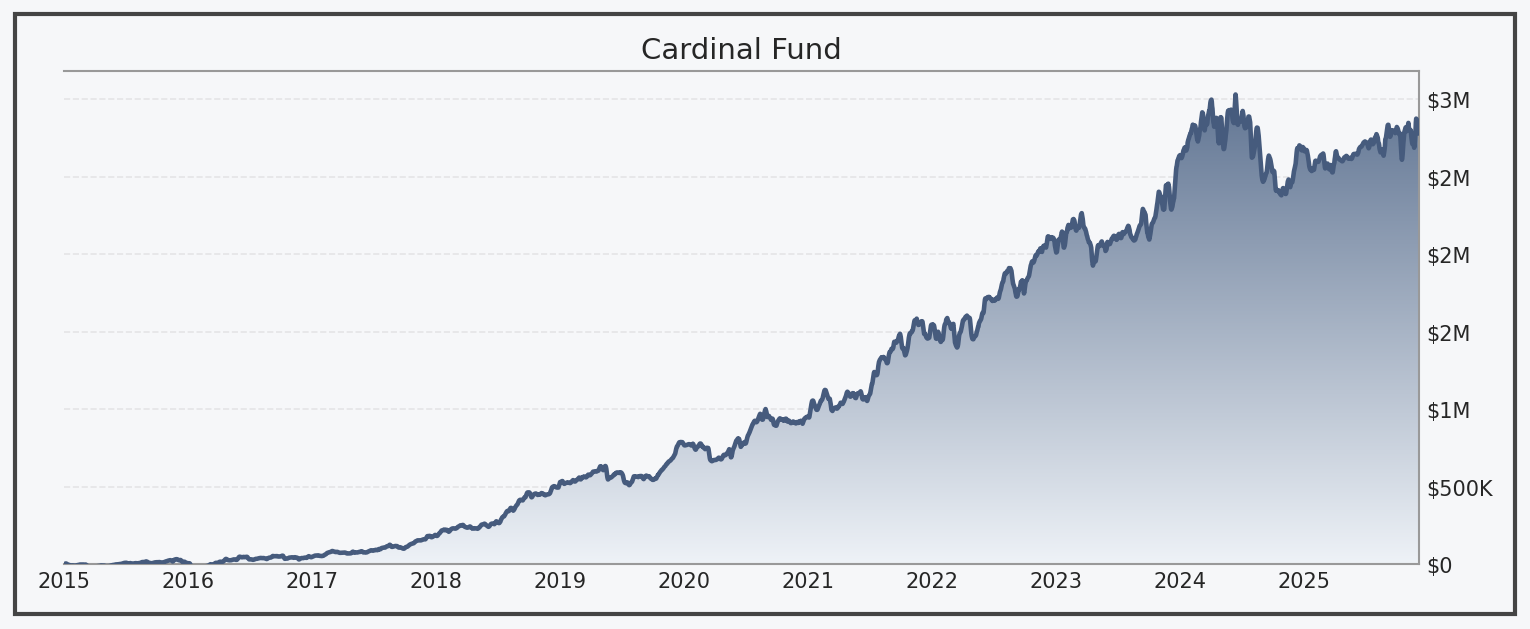

Growth of $100K Portfolio Equity Curve

Operating live as of 2025. 2005 - 2025 out-of-sample simulated results. Net of all trading costs.

Average Annualized Returns

Average annualized returns for our recent most 1-, 3- and 5- year performance.